Changes in market rules are common here; trading is a dynamic and unpredictable area.

Fluctuations in markets caused by changes in international trade laws only highlight the need to adapt. Every trader must be ready to quickly respond to these challenges to minimize risks and extract maximum benefits from each transaction performed.

Avoiding risks and adapting to innovations are two main factors for successful trade, but how realistic is it to keep your finger on the pulse and not miss anything important?

AlterView Group has prepared the top 5 recommendations that will help you successfully adapt to changing conditions.

1. Develop a clear deal management plan

Successful onboarding requires strict control over each transaction. Here’s how to do it:

- Set clear rules for entering and exiting trades. For example, determine your stop loss and take profit levels in advance.

- Regularly review your strategies to ensure they comply with new regulations.

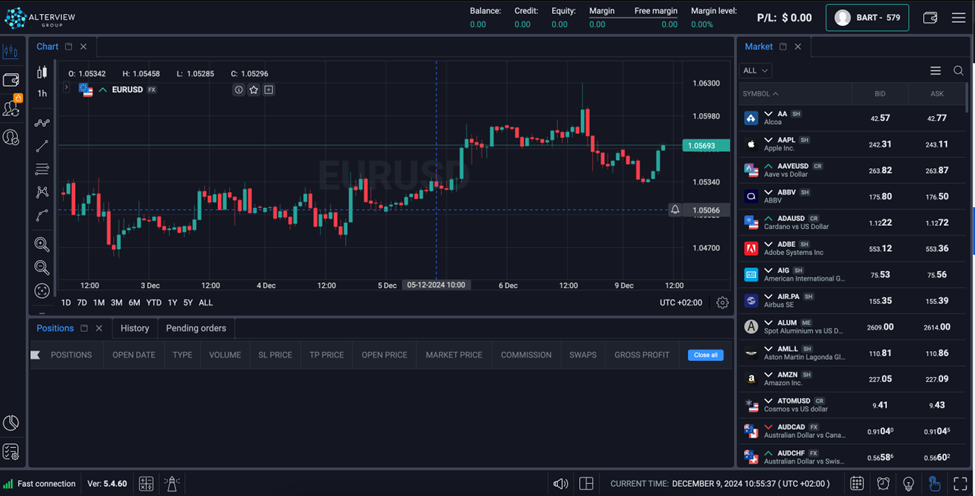

- Use the tools AlterView Group to monitor compliance with established rules.

Planning for each trade reduces the impact of changes on your portfolio and helps maintain stability.

2. Use a risk-reward ratio

Regulations can change trading conditions, so it is important to adapt risk management:

- Maintain a risk to reward ratio of at least 1:2 to minimize losses.

- Apply equity risk techniques, where no more than 2% of capital is used in one transaction.

- Use analytical tools AlterView Group to calculate optimal risk levels.

These steps will help maintain a balance between profitability and security.

3. Manage your capital and position

As regulations change, money management becomes critical. Follow these guidelines:

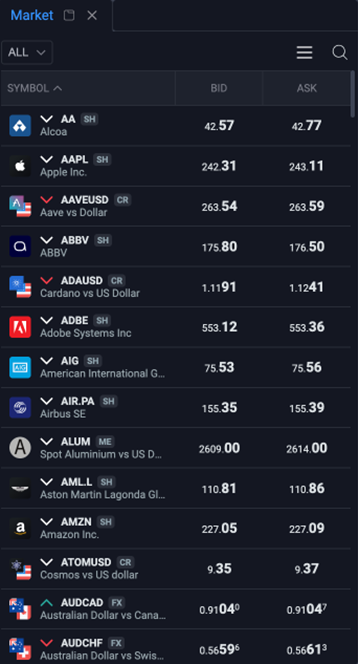

- Diversify your portfolio by including different asset classes such as stocks, bonds and cryptocurrencies.

- Set position size limits based on market volatility.

- Maintain an emergency fund to cover losses in the event of unexpected volatility.

Proper money management will protect you from significant financial losses.

4. Seek professional help

Understanding new regulations can be challenging, especially if you operate in international markets. In such cases, it is better to seek advice from professionals:

- Order a personalized report from AlterView Group, including recommendations for compliance with new requirements.

- Use the services of financial advisors to review your portfolio under the new rules.

- Participate in monthly webinars from AlterView Group, where experts analyze current changes and their impact on the market.

Professional help gives confidence and reduces the likelihood of mistakes.

5. Portfolio allocation

To minimize the impact of market changes, it is worth diversifying your investments:

- Allocate 60% of your portfolio to stable assets such as gold, bonds and stablecoins to reduce your overall risk.

- Use the remaining 40% for riskier assets, including cryptocurrencies and high-yield stocks, to maintain growth potential.

- Implement tools AlterView Group to create and test asset diversification simulations.

These steps will help you effectively balance risk and return.

Changes in the market are an inevitable part of trading. However, with the right approach, they can be used to your advantage. Setting up alerts, learning, managing risk, consulting with experts, and diversifying your portfolio are key steps to successful adaptation. AlterView Group provides all the necessary tools and support so that you can trade with confidence even in volatile conditions.

Stay informed, develop, and take advantage of new opportunities with AlterView Group!